If households view a tax cut as temporary, then the tax cut

a. has no effect on aggregate demand.

b. has more of an effect on aggregate demand than if households view it as permanent.

c. has the same effect as when households view the cut as permanent.

d. has less of an effect on aggregate demand than if households view it as permanent.

d

You might also like to view...

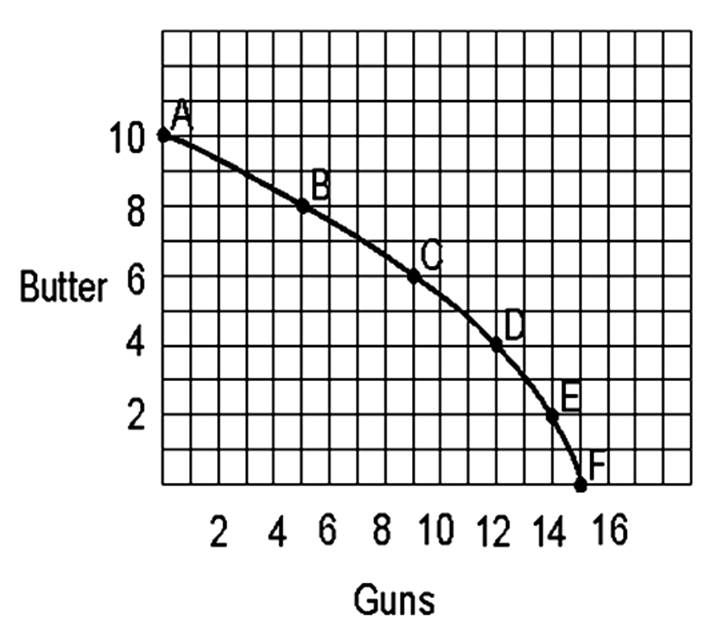

A country producing a combination of 9 units of guns and 6 units of butter would be _____________ (outside/on/inside) the production possibilities curve.

The "marginal rate of substitution" between two goods is measured by:

A) the ratio of the market prices of the two goods. B) the number of units of a good consumed divided by the market price of the other good. C) the number of units of one good a consumer would give up to consume one more unit of another good, while holding total utility constant. D) the consumer's budget constraint divided by the price of each good.

Most countries tend to follow only one price index to measure the price level in an economy because all prices rise or fall at the same time or by the same amount

a. True b. False Indicate whether the statement is true or false

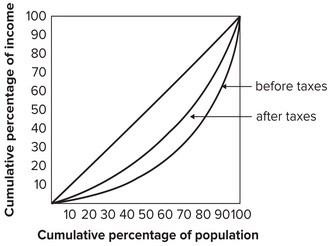

Refer to the graph shown. A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A. is progressive. B. is proportional. C. is regressive. D. does not affect income inequality.