Explain how a "leaky bucket" can be used to illustrate the utilitarian argument that governments should not attempt to completely equalize individual incomes

Utilitarians reject complete equalization of income because they believe that people respond to incentives. As such, redistribution will reduce some people's work efforts, which can actually lead to less total income generated in the economy. If the government attempts to redistribute income from the rich to the poor through taxes, some of the money will be lost due to the distorted incentives and deadweight losses associated with the taxes. We can think of the government as transporting the redistributed income in a "leaky bucket.".

You might also like to view...

The intersection of a firm's marginal revenue and marginal cost curves determines the level of output at which

a. total revenue is equal to variable cost. b. total revenue is equal to fixed cost. c. total revenue is equal to total cost. d. profit is maximized.

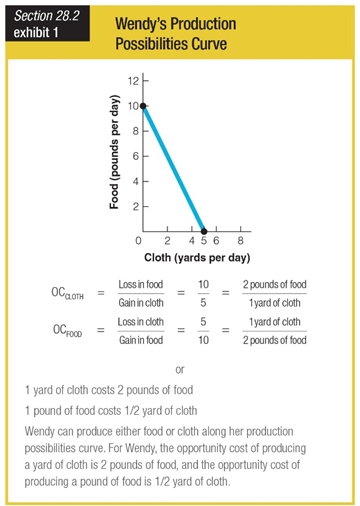

What is Wendy’s opportunity cost of producing a yard of cloth?

a. 3 pounds of food

b. 2 pounds of food

c. 1 pound of food

d. 1/2 pound of food

Explain why the Phillips curve on average is downward sloping

What will be an ideal response?

A direct expenditure offset occurs when an increase in government spending

A. is followed by an increase in consumer spending B. results in a decrease in private spending. C. is followed by an increase in taxes. D. results in an increase in household saving for retirement.