In an attempt to reduce poaching of elephant tusks for ivory, officials in Kenya burned illegally gathered ivory. Economists tend to point out that

a. poaching can be reduced with price supports for ivory.

b. the supply of ivory has fallen, leading to an increase in price and reward for poaching.

c. burning ivory decreases demand, leading to lower prices and reward for poaching.

d. the demand for ivory is higher, leading to an increase in price and reward for poaching.

e. burning ivory raises demand, and controlled prices will lead to even greater poaching.

b

You might also like to view...

Maria Brown is a young tennis player who has shot to fame after defeating Sarah Knowels in three consecutive matches. In the fourth match, Sarah decided to serve left each time. Is this an optimal winning strategy for Sarah?

What will be an ideal response?

Technological progress has made it possible for firms such as Apple and Alivecor to develop small electronic devices, including smartwatches, smartphones, and products that can be attached to the smartwatches and smartphones, to serve consumers who

have become more health conscious and wish to monitor various health conditions. These firms are reacting to which of the three key economic ideas? A) people are rational B) people respond to economic incentives C) firms attempt to maximize revenues D) optimal decisions are made at the margin

If a firm is the sole employer of a factor of production, it is known as

A) a monopsony. B) a monopoly. C) an economically discriminating firm. D) a competitor.

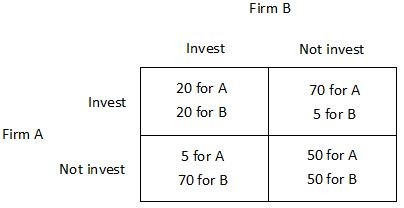

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital. An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

A. $50 million B. $20 million C. $35 million D. $30 million