An expansionary monetary policy is most likely to produce an inflationary effect with little impact on output when the economy

a. is near full employment and the aggregate supply curve is horizontal.

b. is near full employment and the aggregate supply curve is vertical.

c. has substantial unemployment and the aggregate supply curve is vertical.

d. has substantial unemployment and the aggregate supply curve is horizontal.

b

You might also like to view...

Suppose you purchased 500 shares of stock in 2013 for $15 a share, and the price now is $20 a share. If you sell the stock, then your capital gain is

A) $2500. B) $1000. C) $10000. D) indeterminate without knowing the inflation rate.

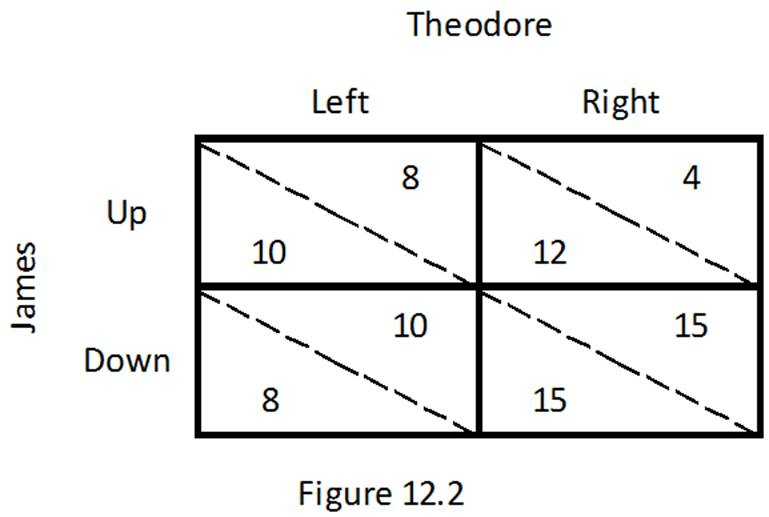

Refer to the game between James and Theodore depicted in Figure 12.2. Which of the following is true?

A. If James chooses Up, Theodore's best response is to choose Right.

B. If James chooses Down, Theodore's best response is to choose Left.

C. If Theodore chooses Left, James's best response is to choose Down.

D. If Theodore chooses Right, James's best response is to choose Down.

Payments to households not in exchange for goods and services currently produced are:

a. transfer payments. b. government purchases. c. consumption expenditures. d. investment expenditures.

The demand curve for Japanese yen is downward sloping because when the exchange rate (measured in dollars per yen) falls,

a. Japanese goods become relatively cheaper so foreigners buy more of them and need more yen to do so. b. foreigners need more dollars to buy one yen so they can now afford more Japanese goods. c. the yen demand curve shifts to the right as foreigners try to buy more Japanese goods. d. the dollar becomes weaker and this reduces the strength of both economies. e. everyone wants fewer yen because they have lost some of their underlying value.