A review of Pranav's reporting of Sec. 1231 transactions for the prior five years indicates a net Sec. 1231 loss of $14,000 three years ago and a net Sec. 1231 gain of $8,000 last year (before the five-year lookback). Pranav will recognize

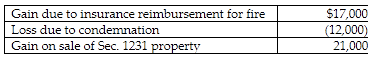

This year Pranav had the gains and losses noted below on property, plant and equipment used in his business. Each asset had been held longer than one year.

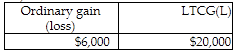

A)

B)

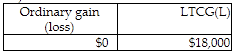

C)

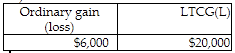

D)

D)

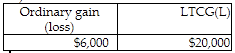

The casualty gain will be treated as Sec. 1231 gain and will be combined with the $12,000 condemnation loss and $21,000 Sec. 1231 gain, resulting in a net Sec. 1231 gain of $26,000. The five-year lookback will require that $6,000 be treated as ordinary gain (prior $14,000 Sec 1231 loss less previously recaptured $8,000 gain), and the $20,000 balance will be treated as LTCG.

Page Ref.: I:13-7 and I:13-8; Example I:13-18

You might also like to view...

Reversing entries make possible the entering of the transactions of the succeeding accounting period in a routine manner

a. True b. False Indicate whether the statement is true or false

Explain the current issues in global marketing research

What will be an ideal response?

A loyal follower will ______.

a. always agree with his or her leader b. never disagree with his or her leader c. not always agree with his or her leader d. disagree with his or her leader in public

Martin Company purchases a machine at the beginning of the year at a cost of $74,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 4 years with a $7000 salvage value. Depreciation expense in year 4 is:

A. $18,500. B. $67,000. C. $0. D. $74,000. E. $16,750.