Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year, 2018, assuming Sec. 179 expensing and bonus depreciation are not claimed?

During the year 2018, a calendar-year taxpayer, Marvelous Munchies, a chain of specialty food shops, purchased equipment as follows:

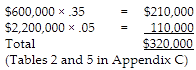

The mid-quarter convention must be used because $2,200,000/$2,800,000 or 66 2/3% of the assets were purchased in the last quarter of the year.

You might also like to view...

Two years ago, Lynn hired 15 new people into her department. Since their hire, they have undergone training, development, performance appraisals, and compensation review/reward. Now it is time to evaluate ________, in terms of productivity, quality, innovation, satisfaction, turnover, absenteeism, health, and other factors.

A. controls B. results C. programming D. methods E. planning

The overselling of private goods results in ________

A) cultural pollution B) misdirected funding C) social costs D) materialism E) opportunity expenses

A project's after-tax net present value is increased by all of the following except

a. revenue accruals. b. cash inflows. c. depreciation deductions. d. expense accruals.

The U.S. government will pay AirSys $2,500,000 each six months, equal to 2.5% of the $100 million face amount of the treasury bonds (5% annual coupon rate, paid in two installments each year), and will repay the $100 million at the end of five years. At the time AirSys purchases the bonds, the market prices these bonds to yield AirSys 6% annually (3% each six months). The bonds are classified as

held to maturity. AirSys will pay an amount equal to _____ for the bonds. a. present value of an annuity of $2.5 million for 10 periods plus the present value of $100 million paid at the end of 10 periods, both cash flows discounted at 3% per period b. present value of an annuity of $5.0 million for 5 periods plus the present value of $100 million paid at the end of 5 periods, both cash flows discounted at 6% per period. c. present value of an annuity of $2.5 million for 10 periods plus the present value of $100 million paid at the end of 10 periods, both cash flows discounted at 2.5% per period. d. present value of an annuity of $5.0 million for 5 periods plus the present value of $100 million paid at the end of 5 periods, both cash flows discounted at 5% per period. e. the future value of cash flows totaling $125 million