Thirsty Dog! Thirsty Cat! AdThe Thirsty Dog! & Thirsty Cat! ad above shows an example of a product that failed in the marketplace. Identify and describe the reason(s) for this unique item's marketing-related product failure.

Thirsty Dog! Thirsty Cat! AdThe Thirsty Dog! & Thirsty Cat! ad above shows an example of a product that failed in the marketplace. Identify and describe the reason(s) for this unique item's marketing-related product failure.

What will be an ideal response?

Thirsty Dog! & Thirsty Cat! failed because it had no economical assess to its customers. The bottled water had to displace existing or similar products (if there were any) on retailers' shelves at pet stores, grocery stores, etc. Moreover, it has to pay both slotting and failure fees to gain and retain access to these shelves. Unfortunately, Thirsty Dog! & Thirsty Cat! failed to generate enough sales to meet retailers' requirements.

You might also like to view...

Sally's LLC, a local supermarket, has all of the following characteristics. Which of the following characteristics of Sally's is most likely to be a more sustainable competitive advantage?

A. Extended hours of operation B. Shared systems with vendors C. More sales promotions D. More employees E. More merchandise

Assume that you own an annuity that will pay you $15,000 per year for 12 years, with the first payment being made today. You need money today to open a new restaurant, and your uncle offers to give you $120,000 for the annuity. If you sell it, what rate of return would your uncle earn on his investment?

A. 6.85% B. 7.21% C. 7.59% D. 7.99% E. 8.41%

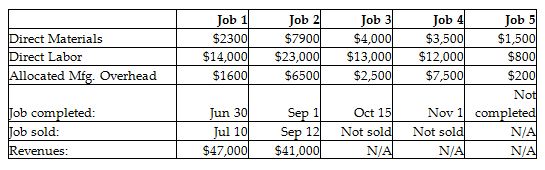

Connecticut Manufacturing began business on January 1. During its first year of operation, Connecticut worked on five industrial jobs and reported the following information at year-end:

Connecticut's allocation of overhead costs left a debit balance of $1400 in the Manufacturing Overhead account, which was adjusted to zero at year-end. What was the final balance in Cost of Goods Sold for the year ended December 31?

A) $55,300

B) $56,700

C) $53,900

D) $17,900

An investment manager enthusiastically reports that his client's stock portfolio has experienced 24 percent growth but does not reveal that the stock market as a whole grew by 32 percent during the same period. Which of the following ethical guidelines has the investment manager ignored?

a. Clear and understandable expression of the idea b. Honest and fair expression of the idea c. Tactful and pleasant expression of the idea d. Graphical support that communicates facts accurately