The state Department of Agriculture raised the minimum price for a gallon of milk in the city on Tuesday to $4.37

"If you've got two or three kids and you're living on a fixed income and you're paying half your income on rent," Gioia said, "then you're really in a bind and you're making choices you should never have to make." If even after this price increase Gioia's marginal utility per dollar is higher for milk than for other goods, what should Gioia do? A) increase her consumption of milk

B) decrease her consumption of milk

C) not change her consumption of milk

D) increase her consumption of milk only if her income increases

A

You might also like to view...

Which of the following is closest to the future value of a $4,000 deposit earning 2 percent interest annually after 10 years?

A. $4,876 B. $4,122 C. $4,805 D. $5,025

Why does a tax change affect aggregate demand?

A. A tax change alters saving by an equal amount. B. A tax change alters imports and net exports. C. A tax change alters government spending by an equal amount. D. A tax change alters disposable income and consumption spending.

All of the following are characteristics of stock except

A) stock does not represent a promise to repay a fixed amount of funds. B) dividends paid to owners of stock represent a firm's profits. C) stock promises to repay a fixed amount to of funds to stock owners. D) stock represents ownership in a firm.

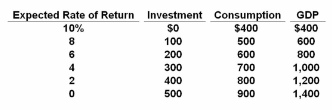

Refer to the table above. An increase in the real interest rate from 2% to 6% will:

A. Decrease the equilibrium level of GDP by $200 billion

B. Decrease the equilibrium level of GDP by $300 billion

C. Decrease the equilibrium level of GDP by $400 billion

D. Increase the equilibrium level of GDP by $400 billion