The chief executive officer earns $10,100 per month. As of May 31, her gross pay was $50,500. The tax rate for Social Security is 6.2% of the first $128,400 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7000 of an employee's pay. What is the amount of FICA-Social Security withheld from this employee for the month of June?

A. $626.20

B. $1252.40

C. $7420.47

D. $270.68

E. $292.90

Answer: A

You might also like to view...

Experienced quality of service is determined by:

A) an image the customer forms after the service encounter. B) market communications and image of the company. C) past experiences that the customer had with company. D) word of mouth communication and customer needs.

Discuss steps involved in developing a new wiki and compare those steps to steps that should be taken when adding material to an existing wiki

Indicate whether the statement is true or false.

The organizational status of the researcher or the research department may make it easy to reach the key DM in the early stages of the project

Indicate whether the statement is true or false

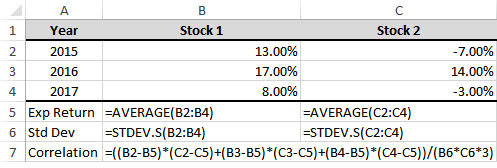

You wanted to verify that formula 14-2 on page 429 is correct, so you entered the formula in B7 and entered Excel’s built-in function CORREL in cell B9; however, you get 47.95% in B7 and 71.93% in B9. Since the formulas in both cells are correct, where is the error?

a) The functions on cells B5 and C5 should be MEDIAN instead of AVERAGE

b) The functions on cells B6 and C6 should be STDEV.P instead of STDEV.S

c) The functions on cells B5 and C5 should be MODE instead of AVERAGE

d) The functions on cells B6 and C6 should be STDEVA instead of STDEV

e) The functions on cells B6 and C6 should be VAR instead of STDEV