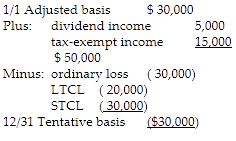

King Corporation, an electing S corporation, is 100% owned by Crystal. On January 1 of the current year, her adjusted basis in the King stock is $30,000. During the year, King reports an ordinary loss of $30,000, tax-exempt municipal bond income of $15,000, dividend income from domestic corporations of $5,000, a long-term capital loss of $20,000, and a short-term capital loss of $30,000. What is

Crystal's basis for the King stock at the end of the year?

What will be an ideal response?

Only $50,000 of the $80,000 total loss can be used, and the stock basis goes to $0. A $30,000 carryover is composed of ratable portions of each of the three types of losses.

You might also like to view...

The employees who interact with dissatisfied guests must be ______.

a. management b. emotionally ready to deal with them c. quick to politely explain how the guest is incorrect d. empowered enough to give the guest whatever they want to fix the problem

Given credit terms of 2/25, n/30 on a sale of $1,500, in how many days must the invoice be paid to take advantage of the discount?

a. 30 b. 15 c. 5 d. 25

A positive feeling of accomplishment, self-praise, and a high sense of purpose are all examples of

What will be an ideal response?

In an unsolicited report, the writer may have a difficult time determining the reader's reaction

Indicate whether the statement is true or false