The budget deficit or surplus is:

A. easy to calculate since there is only one valid method for computing it.

B. easy to calculate since economists agree on how it should be computed.

C. hard to calculate even though there is only one valid method for computing it.

D. hard to calculate since economists disagree on how it should be computed.

Answer: D

You might also like to view...

Why does government provide educational opportunities in the form of vouchers, private subsidies, and public provision?

What will be an ideal response?

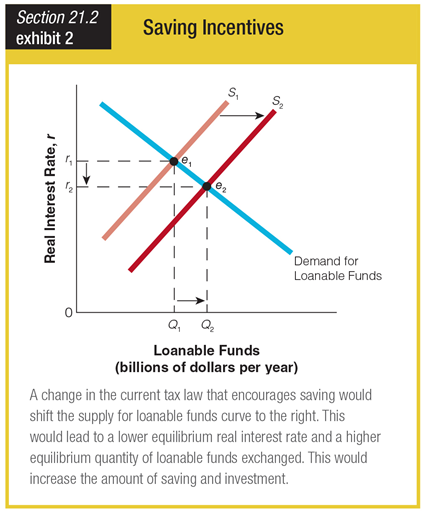

Based on the graph for saving incentives, a tax law change encouraging saving would ______.

a. create a higher equilibrium quantity of loanable funds exchanged

b. create a lower equilibrium quantity of loanable funds exchanged

c. have no influence on the equilibrium quantity of loanable funds exchanged

d. drive the equilibrium quantity of loanable funds exchanged to zero

What is the lowest price the firm would accept in the long run?

The deficit is

A. total tax revenues minus net interest minus government expenditures. B. the primary deficit minus net interest payments. C. the amount by which government purchases, transfers, and net interest exceed tax revenues. D. the amount by which government purchases and transfers exceed tax revenues.