Which of the following explains why the demand for loanable funds is negatively related to the real interest rate?

A) A lower real interest rate makes more investment projects profitable.

B) Consumers are willing to spend less and hence save more at higher real interest rates.

C) Interest rate flexibility in financial markets assures an equilibrium in which saving equals investment.

D) All of the above are reasons why the demand for loanable funds is negatively related to the real interest rate.

A

You might also like to view...

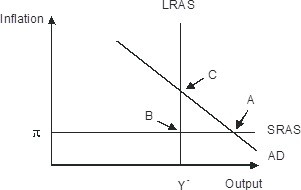

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

If a single union supplies all the labor in a competitive labor market, the union probably will

A. increase labor supply to raise employment. B. restrict labor supply to raise wages. C. increase union membership to increase wages. D. act like a competitive firm.

If the marginal total cost when moving from Option A to Option B is negative and the marginal total cost when moving from Option B to A is positive, which of the two options is better? What is the underlying principal behind the decision?

What will be an ideal response?

What is the total cost at the break-even quantity calculated above?

a. $750 b. $850 c. $950 d. $1050