On June 3, Maryland Company purchased merchandize worth $800 on credit, terms 2/10, n/30 . The amount paid on June 15 . What is the required journal entry to record the payment under the periodic inventory system?

a. Accounts Payable 784

Purchases Discounts 16

Cash 800

b. Accounts Payable 800

Purchases Discounts 16

Cash 784

c. Cash 800

Accounts Payable 800

d. Accounts Payable 800

Cash 800

D

You might also like to view...

Under the equity method, the receipt of cash dividends on an investment in common stock of Vallerio Corporation is accounted for as a debit to Cash and a credit to

a. Investment in Vallerio b. Retained Earnings c. Dividend Revenue d. Dividend Receivables

Krenshaw Company reported total sales revenue of $80,000, total expenses of $72,000, and net income of $8,000 for the year ended December 31, 2009 . During 2009, accounts receivable increased by $3,000, merchandise inventory decreased by $2,000, accounts payable increased by $1,000, and $5,000 in depreciation expense was recorded. Assuming no other adjustments to net income are needed, the net

cash inflow from operating activities using the indirect method was a. $19,000 b. $13,000 c. $10,000 d. $11,000

Prejudice is defined as:

a. A preconceived judgment or opinion held by members of a group b. A standardized, oversimplified mental picture that is held in common by members of a group c. A preconceived opinion, not based on reason or experience d. A statement of being subject to specific treatment or control

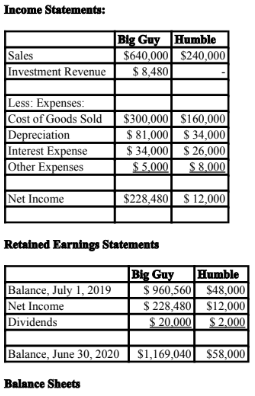

The amount of other expenses appearing on Big Guy's June 30, 2020 consolidated income statement would be:

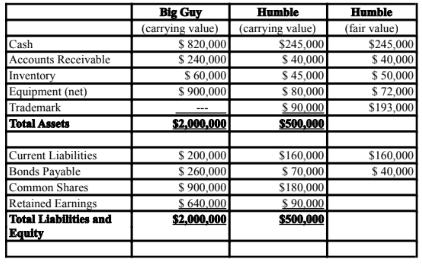

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2017. On that date, Humble Corp. had Common Shares and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2027. Both companies use straight line amortization, and no salvage value is assumed

for assets. The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment. The balance sheets of both companies, as well as Humble's fair market values on the date of acquisition are disclosed below:

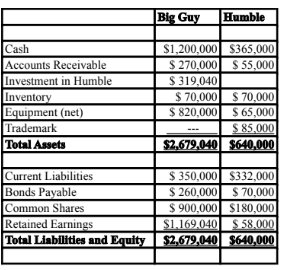

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2020:

An impairment test conducted in September 2018 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2020, Humble Inc. borrowed $20,000 in cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in

Humble Corp. Assume that the entity method applies.

A) $13,000. B) $11,600. C) $12,000. D) $13,400.