Excise tax is considered ______ because lower earners pay a ______ percentage of their income for this type of tax.

a. progressive; higher

b. regressive; lower

c. regressive; higher

d. progressive; lower

c. regressive; higher

You might also like to view...

You have decided that you are going to consume 600 calories of beer and snacks at a party Saturday night. A beer has 150 calories and a snack has 75 calories

a. Create a table that shows the various combinations of beer and snacks you can consume. To keep things simple, use only round numbers (e.g., you could choose 1 or 2 beers but not 1.5 beers). b. What is the opportunity cost of a beer?

When the current U.S. income tax system was instituted in 1913, the rate on the highest tax bracket was _____

a. 28 percent b. 1 percent c. 15 percent d. 7 percent

The long-run effect of rent control on an area includes

A) rampant building of new low-income housing. B) many new luxury apartments new luxury apartments will be built. C) new investors into the real estate market in the area. D) less investment into the real estate market in the area.

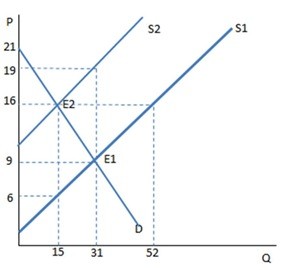

The graph shown demonstrates a tax on sellers. Who bears the greater tax incidence?

The graph shown demonstrates a tax on sellers. Who bears the greater tax incidence?

A. The sellers B. The buyers C. The incidence is equally shared between buyer and seller. D. The government