Which of the following is NOT a "flow" variable?

A) government debt

B) consumption expenditure

C) labor services

D) income

A

You might also like to view...

Lucy invested $10,000 at the rate of 12%. According to the rule of 72, it would take ______ years for her money to double

a. 4 b. 5 c. 6 d. 7

If the transaction between you and the seller takes place at a price that equals your valuation of the product, then:

a. you realize all the gains from this transaction. b. the gains from this transaction are equally divided between the two of you. c. the entire economic value created by the transaction goes to the seller. d. the economic value created by this transaction is sub-optimal.

If a firm's output equals 10, product price equals $5.00, TFC = $8.00, and TVC = $60.00, then ATC would equal

a. $.80 b. $1.00 c. $6.00 d. $6.80 e. $8.00

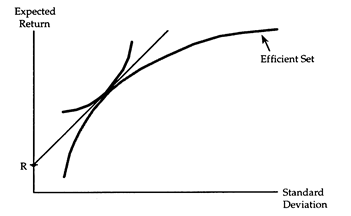

Consider the accompanying diagram, which shows an investor who can choose to hold the risky assets on the efficient set and/or the risk-free asset labeled R.

(i) Describe the portfolio held by this investor.

(ii) Suppose the expected return of the risk-free asset increases. Complete the diagram to show how the investor responds to this change. Describe how the market portfolio changes, and describe the new portfolio held by the investor.

(iii) Assume that as the investor's income rises, he prefers that his portfolio have a higher expected return and a lower standard deviation. When the expected return of the risk-free asset rises, does the expected return of the investor's portfolio rise or fall? Does the standard deviation of the investor's portfolio rise or fall? Explain, using substitution and income effects.