As assistant manager of a discount department store, you have been asked to review the store's policy concerning shoplifters. (a) Discuss the legal standard used in most states governing the detention of suspected shoplifters. (b) In reviewing the store's policy, discuss some of the items that you will consider

a) Generally, a store may detain a customer for alleged shoplifting provided there is a reasonable basis for the suspicion and the detention is done reasonably.

b) Some of the items that should be considered include: what is a "reasonable" suspicion of shoplifting; what is "reasonable" detention; how private should the detention be; how can bias and prejudice be avoided; and how much questioning should the store do.

You might also like to view...

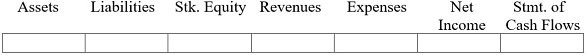

Use the information below to answer the following question(s):Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.Increase = I Decrease = D No Effect = NAGarrison Company recognized $4,000 of service revenue earned on account.

What will be an ideal response?

The four levels of CSR are ______.

A. economic, legal, ethical, and discretionary B. economic, legal, ethical, and demanded C. economic, legal, egalitarian, and discretionary D. economic, legal, ethical, and dominant

Product planners need to consider products and services on three levels. At the second level, product planners must ________

A) offer additional product support and after-sale services B) identify the core customer value that consumers seek from the product C) turn the core benefit into an actual product D) find out how they can create the most satisfying brand experience E) define the problem-solving benefits or services that consumers seek

Under the direct method, which of the following would not be included in the operating section of the cash flow statement?

A. Cash receipts from customers B. Cash payments to purchase insurance C. Cash payments to purchase long-term equipment D. Cash payments for income taxes