The typical monopolistic competitor

A. is a large firm.

B. may be a drugstore, restaurant, gas station, or dry cleaner.

C. never advertises.

D. has a local monopoly.

B. may be a drugstore, restaurant, gas station, or dry cleaner.

You might also like to view...

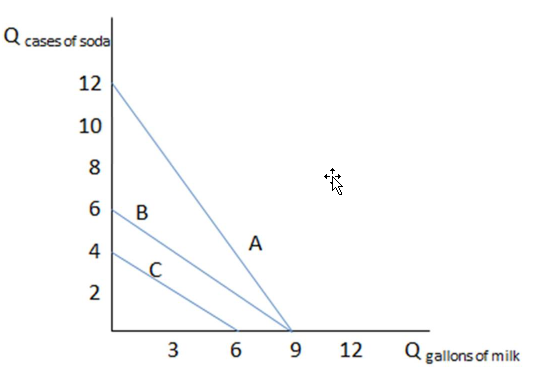

If Gary has budget constraint A, and the price of milk is $3 a gallon, what is Gary's income?

This graph shows three different budget constraints: A, B, and C.

A. $9

B. $27

C. $12

D. Cannot answer this without knowing the price of soda.

How has the share of the personal income tax paid by the rich (the top 1 percent of earners) and the not-so-well-off (the bottom half of earners) changed during the last four decades?

a. The rich now pay a larger share and the not-so-well-off pay a smaller share of the personal income tax. b. The rich now pay a smaller share and the not-so-well-off pay a larger share of the personal income tax. c. The share of the personal income tax paid by the rich increased between 1960 and 1980, but the share of the revenues collected from the rich has declined sharply since 1980. d. The relative shares paid by the rich and the not-so-well-off have been virtually unchanged during the last four decades.

Exhibit 7-9 Cost schedule for firm X OutputQuantity Total FixedCost Total VariableCost 0 $100 $ 0 1 100 50 2 100 84 3 100 108 4 100 127 5 100 150 As shown in Exhibit 7-9, the average total cost of producing 5 units is:

A. $20. B. $30. C. $50. D. $250.

Fiscal policy is enacted through changes in

A. unemployment and inflation. B. the supply of money and foreign exchange. C. taxation and government purchases. D. interest rates and the price level.