What is the total amount of her for AGI deduction for these fees?

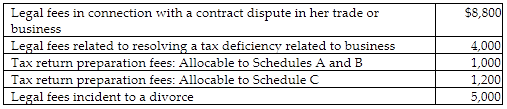

Leigh pays the following legal and accounting fees during the year:

A) $10,800

B) $14,000

C) $15,000

D) $20,000

B) $14,000

$8,800 + $4,000 + $1,200 = $14,000; the tax return fees allocable to Schedules A and B and legal fees incident to a divorce are not deductible.

You might also like to view...

Which of the following statements is true of the internal rate of return??

A. ?It is the required rate of return to achieve value maximization. B. ?It is the discount rate that equates the present value of the cash outflows (or costs) with the present value of the cash inflows. C. ?It is the discount rate at which the net present value of a project is minimum. D. ?It is the rate of return at which a project's payback period is shortest. E. ?It is the discount rate to be used for a project with multiple cash outflows.

The most common type of corporation is an S corporation.

Answer the following statement true (T) or false (F)

Wholesalers and retailers who connect manufacturers to consumers are referred to as ________.

A. manufacturing agents B. distribution channels C. business franchisors D. traffic generators

Spohn Clinic uses client-visits as its measure of activity. During February, the clinic budgeted for 3,400 client-visits, but its actual level of activity was 3,370 client-visits. The clinic has provided the following data concerning the formulas to be used in its budgeting for February: Fixed Element per MonthVariable element per client-visitRevenue - $28.10 Personnel expenses$26,100 $7.70Medical supplies 900 5.10Occupancy expenses 5,600 0.80Administrative expenses 4,300 0.40Total expenses$36,900 $14.00?The medical supplies in the flexible budget for February would be closest to:

A. $17,512 B. $18,087 C. $18,240 D. $17,204