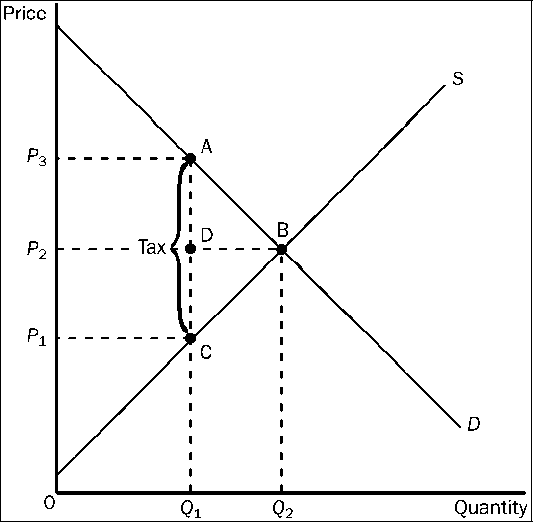

Figure 4-24

Refer to . The price that buyers pay after the tax is imposed is

a.

P1.

b.

P2.

c.

P3.

d.

impossible to determine from the figure.

c

You might also like to view...

What is the free-rider problem? What results from the free-rider problem? What is a solution to the free-rider problem?

What will be an ideal response?

The negative slope of the demand curve reflects the

a. positive relationship between price and quantity b. proportional relationship between price and quantity c. inverse relationship between price and quantity d. positive relationship between income and quantity e. inverse relationship between income and price

Stock analysts often argue that lower interest rates are good for the stock market. Does this argument make sense?

a. No; lower interest rates will tend to slow down the economy and this will be bad for the stock market. b. Yes; the lower rates of interest will increase the value of future income (and capital gains) and stock prices will rise to reflect this factor. c. No; the lower rates of interest will reduce the value of future income (and capital gains) and this will cause stock prices to fall. d. Yes; the lower interest rates will cause inflation and inflation is generally good for the stock market.

A natural measure of the association between two random variables is the correlation coefficient.

Answer the following statement true (T) or false (F)