Stock analysts often argue that lower interest rates are good for the stock market. Does this argument make sense?

a. No; lower interest rates will tend to slow down the economy and this will be bad for the stock market.

b. Yes; the lower rates of interest will increase the value of future income (and capital gains) and stock prices will rise to reflect this factor.

c. No; the lower rates of interest will reduce the value of future income (and capital gains) and this will cause stock prices to fall.

d. Yes; the lower interest rates will cause inflation and inflation is generally good for the stock market.

B

You might also like to view...

In long-run equilibrium, the perfectly competitive firm produces

a. where P = MC = AC. b. at the lowest point on its long-run average cost curve. c. where its long-run average cost curve is tangent to its horizontal demand curve. d. All of the above are correct.

When investors follow a "herd instinct," they:

A. only makes decisions as a group, making it hard to determine individual behavior. B. make decisions as a group, inflating the prices of goods somewhat arbitrarily. C. invest in something simply because everyone else is doing it. D. invest in something as a group, making it appear more valuable than it is.

Frictional unemployment would increase when

A. the number of individuals who quit one job to find another increases. B. discouraged workers drop out of the work force. C. migrant workers are unemployed after harvest season. D. workers are replaced by machines in production.

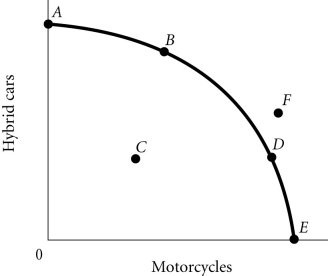

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point A necessarily represents

Figure 2.4According to Figure 2.4, Point A necessarily represents

A. only hybrid cars being produced. B. an unattainable production point. C. what society wants. D. the economy's optimal production point.