One problem that investors in foreign countries face is the possibility of a decline in the value of that foreign country's currency. Which of the following would be an effective way to offset this problem?

A) Be ready to pull out at the first sign of trouble.

B) Convert as many of your dollars into their dollars as possible.

C) Hedge through currency swaps.

D) Finance your investment outside of that country.

Answer: C

You might also like to view...

The money supply is $10 million, currency held by the nonbank public is $2 million, and the reserve—deposit ratio is 0.2. Bank deposits are equal to

A) $1.6 million. B) $2 million. C) $4 million. D) $8 million.

The power of the test is

A) dependent on whether you calculate a t or a t2 statistic. B) one minus the probability of committing a type I error. C) a subjective view taken by the econometrician dependent on the situation. D) one minus the probability of committing a type II error.

Elasticity of demand is closely related to the slope of the demand curve. The less responsive buyers are to a change in price, the

a. steeper the demand curve will be. b. flatter the demand curve will be. c. further to the right the demand curve will sit. d. closer to the vertical axis the demand curve will sit.

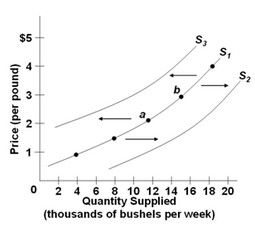

Use the figure below to answer the following question. The diagram shows three supply curves for apples. Which of the following would cause the supply of apples to shift from S1 to S3?

The diagram shows three supply curves for apples. Which of the following would cause the supply of apples to shift from S1 to S3?

A. a new bacteria that destroys apple crops B. a decrease in the price of apples C. an increase in the number of acres of farmland allocated to apple trees D. a new genetically modified apple seed that is resistant to drought