The government raises the marginal income tax rates so that after-tax wages are decreased. This most likely will shift the labor

A. demand curve to the right.

B. supply curve to the left.

C. supply curve to the right.

D. demand curve to the left.

Answer: B

You might also like to view...

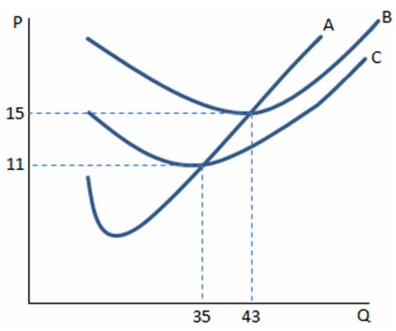

Of the curves displayed in the graph shown, what does curve B most likely represent?

A. Marginal cost

B. Average total cost

C. Average variable cost

D. Average fixed cost

Which of the following would cause the money demand curve to shift to the left?

A. An increase in interest rates B. Inflation C. A technological advance, like online shopping D. An increase in GDP

The argument that rising energy prices caused the decline in U.S. productivity in the 1970s is made less believable due to the

a. falling level of saving in the 1970s. b. falling level of energy prices in the 1980s. c. rising level of energy prices in the 1980s. d. rising level of energy prices in the 1990s.

Since 1929, total government taxes as a percentage of GDP:

a. climbed from 10 percent to about 30 percent. b. remained close to 30 percent. c. climbed from 30 percent to about 50 percent. d. climbed from 15 percent to about 50 percent.