Most of the taxes collected by governments tend to

a. remain fixed.

b. move in the opposite direction from GDP.

c. be sales taxes.

d. rise and fall with the level of GDP.

d

You might also like to view...

Why might economic policies aimed at stabilization actually increase the magnitudes of economic fluctuations?

What will be an ideal response?

Which of the following is an example of industrial policy?

a. Government imposing a high rate of taxes on the profits of large corporate houses b. Government spending more on the construction of roads and bridges than on education c. Government imposing a high rate of taxes on the import of goods and services d. Government charging lower rate of taxes on the import of goods and services e. Government selling imported cash crops at a subsidized rate

When economists speak of "demand" in a particular market, they refer to

A. the whole demand curve or schedule. B. one price-quantity combination on the demand schedule. C. one point on the demand curve. D. how much of an item buyers want to buy at a given price.

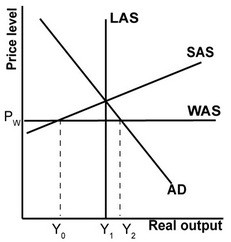

In the graph shown, a downward shift in the SAS curve:

A. raises domestic consumption, because domestic producers produce more. B. lowers globalized potential output, because domestic producers are more competitive. C. raises the trade deficit, because domestic producers are more competitive. D. raises domestic production, because input prices have fallen.