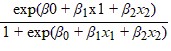

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank. The rating is based on the probability of defaulting on credit cards and is as follows. RatingProbability of DefaultingExcellentp ? 0.05Good0.05 < p ? 0.10Fair0.10 < p ? 0.25 Poorp > 0.25To estimate this probability, she decided to use the logit model P =  , wherey = a binary response variable which is 1 if the credit card is in default and 0 otherwisex1 = the ratio of the credit card balance to the credit card limit (in %)x2 = the ratio of the total debt to the annual income (in %)The following output is obtained.VariableLogistic ModelIntercept?8.98 (p-value =

, wherey = a binary response variable which is 1 if the credit card is in default and 0 otherwisex1 = the ratio of the credit card balance to the credit card limit (in %)x2 = the ratio of the total debt to the annual income (in %)The following output is obtained.VariableLogistic ModelIntercept?8.98 (p-value =

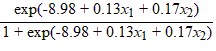

0.0089)x1 - Balance Ratio0.13 (p-value = 0.0054)x2 - Debt Ratio0.17 (p-value = 0.0067)Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.What is the estimated logit model?

What will be an ideal response?

=

=

You might also like to view...

Core competencies ______.

A. are also known as competitive strengths within a business unit B. refer to the skills a business needs to acquire C. are not relevant for a diversified organization D. can be outsourced

According to the 10 characteristics of servant leadership, stewardship is ______.

A. clear and persistent communication that convinces others to change B. attempting to see the world from another’s point of view C. referring to the leader’s ability to see the future D. taking responsibility for the leadership role

Which financial statement illustrates how the company's operating, investing, and financing activities have affected cash over a specified period of time?

A) ?Balance sheet B) ?Statement of financial position C) ?Statement of cash flows D) ?Income statement. E) ?Profit and loss statement

Effective change managers leverage two parts of any change issue: the hard side and the soft side. Explain which side managers feel more comfortable working with and why. Contrast between the two