Which of the following would be classified as fiscal policy?

A) The federal government cuts taxes to stimulate the economy.

B) States increase taxes to fund education.

C) A state government cuts taxes to help the economy of the state.

D) The Federal Reserve cuts interest rates to stimulate the economy.

E) The federal government passes tax cuts to encourage firms to reduce air pollution.

A

You might also like to view...

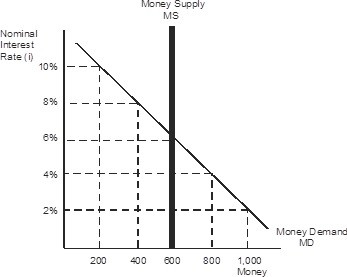

Refer to the figure below where the nominal interest rate equals 6% and the money supply equals 600. If the Federal Reserve wants to lower the interest rate to 4%, it must ________ the money supply to ________.

A. increase; 1,000 B. increase; 800 C. decrease; 800 D. decrease; 400

A shoe retailer does not give a bill for shoes purchased from his store and does not report his income correctly to evade taxes. If you pay him $50, ________

A) the GDP of your country will fall B) the GDP of your country will increase C) the trade surplus of your country will increase D) the GDP of your country will remain unchanged

An economy in which government bureaucracy decides how much of a good to produce, how to produce the good, and who gets the good is known as a

A) centrally planned economy. B) market economy. C) mixed economy. D) laissez-faire economy.

The inflation rate that is used to set the money wage rate and other money prices is the

A) actual inflation rate. B) cost of living inflation rate. C) natural inflation rate. D) expected inflation rate. E) wage inflation rate.