How does rapid price adjustment, as assumed in classical models, result in separation of real from nominal variables (the classical dichotomy)?

What will be an ideal response?

If an increase in the money supply enables consumers and businesses to spend more, there is upward pressure on equilibrium prices. Producers will raise prices. They might consider increasing output, as well, but will reconsider when they see that labor and other inputs have increased in price. There will be no increase in saving, because the increase in the money supply is needed to fund the same volume of transactions at the higher price level. The nominal interest rate will rise, so long as the price level is expected to continue to rise. The real interest rate is unaffected, as are real output, consumption, and investment.

You might also like to view...

The price of a factor of production that is in fixed supply is called

A) opportunity cost. B) a compensating differential. C) economic rent. D) economic profit.

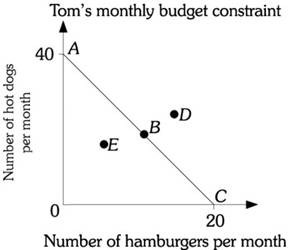

Refer to the information provided in Figure 6.1 below to answer the question(s) that follow. Figure 6.1Refer to Figure 6.1. Assume Tom's budget constraint is AC. If the price of a hot dog is $3, the price of a hamburger is

Figure 6.1Refer to Figure 6.1. Assume Tom's budget constraint is AC. If the price of a hot dog is $3, the price of a hamburger is

A. $1.50. B. $3. C. $6. D. $12.

The policy position that the supply of money should be increased at a constant rate each year is most closely associated with the views of:

A. Monetarism B. Real business cycle theory C. Mainstream economics D. Supply-side economics

What are the measures of performance for investment centers? How do they work?

What will be an ideal response?