According to the theory of efficient markets:

A. investors use rules of thumb to make choices about which stocks to buy and sell.

B. investors are able to use forecasts based on the dividend-discount model to generate above- average returns.

C. the stock price should remain constant.

D. a portfolio manager who charges no commission should not, on average, outperform an individual investor with access to the same funds.

Answer: D

You might also like to view...

Unreimbursed medical expenses in excess of 8.5% of AGI are tax deductible.

A. True B. False C. Uncertain

Business-cycle macroeconomics involves increases in Real GDP that result from a rightward-shifting LRAS curve

Indicate whether the statement is true or false

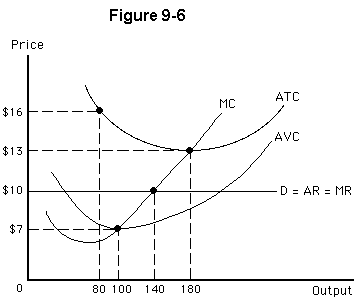

Figure 9-6 shows the marginal cost and average total cost curves for a perfectly competitive firm. This firm will

a.

earn an economic profit

b.

suffer an economic loss in this long-run situation

c.

suffer an economic loss in the short run and close

d.

break even if it expands to 180 units of output

e.

suffer an economic loss and continue producing in the short run

Assuming an economy is initially at potential output, in the long run, an expansionary monetary policy is expected:

A. not to affect output in either the short run or the long run. B. to affect output in both the short run and the long run. C. not to affect output in the long run. D. to affect output, but only in the long run.