China's current rate of GDP growth is quite rapid. Its current growth rate is probably three times that of the United States. However, the levels of pollution are much higher in China. Would you consider China to be better off than the United States

given this information? Why or why not?

What will be an ideal response?

China is not better off because of higher rates of growth of GDP. GDP is not a perfect measure of well-being. GDP is not adjusted for pollution or other negative effects of production. Certainly the rapid growth of GDP raises the standards of living of many in China. However, this comes at a cost of dirty air and water. According to the World Health Organization, seven of the ten most polluted cities in the world are in China. This pollution can result in negative health effects. The improvement in standards of living affect well-being in a positive manner, but the increased pollution has a negative effect on well-being. In addition, GDP per capita may be a better measure of standard of living rather than growth in GDP.

You might also like to view...

What happens to wage and rental rate according to the Heckscher-Ohlin model if the price of a good that uses capital extensively increases by 6%?

a. Both wage and rental rate decrease by 6%. b. Both wage and rental rate increase by less than 6%. c. Both wage and rental rate increase by more than 6%. d. Wage rate increases by more than 6% but rental rate decreases. e. Wage rate decreases but rental rate increases more than 6%.

________ in the foreign interest rate causes the demand for domestic assets to ________ and the domestic currency to appreciate, everything else held constant

A) An increase; increase B) An increase; decrease C) A decrease; increase D) A decrease; decrease

We can roughly estimate how long it will take a country to double its real GDP per capita using the:

A. rule of 70. B. rule of 60. C. growth estimator. D. GDP deflator.

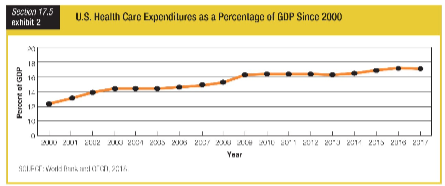

Based on the graph showing U.S. health care expenditures as a percentage of GDP, the percentage has ______ from 2000 to 2017.

a. risen about 3 percent

b. risen about 10 percent

c. been cut in half

d. remained unchanged