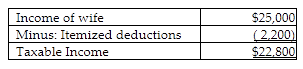

Husband and wife, who live in a common law state, are eligible to file a joint return for 2018, but elect to file separately. Wife has adjusted gross income of $25,000 and has $2,200 of expenditures which qualify as itemized deductions. Husband deducts itemized deductions of $14,200. What is the taxable income for the wife?

A) $13,000

B) $22,800

C) $25,000

D) None of the above.

B) $22,800

If one spouse on married filing separately returns itemizes deductions, the other spouse must also do so.

You might also like to view...

One of the potential drawbacks of a ________ is that salespeople might simply wait to make some sales instead of increasing their overall number of sales

A) monthly call report B) behavioral objective C) performance objective D) sales contest E) customer relationship management report

When evaluating market segments, assessment of competitors is important because

A. it is difficult to segment a market when it has multiple competitors. B. an absence of competitors usually creates difficulties in accurately measuring segment sales potential. C. sales estimates may cause a segment to appear to be lucrative, but there may be several competitors that together have a large share of that segment. D. a competitive analysis may lead to confusion as to who are the key competitors. E. competition is generally not a major problem as long as a marketer is aware of it.

The federal Civil Rights Act of 1964 does not apply to the U.S. Government.?

Indicate whether the statement is true or false

If the obtained value is higher than the critical value, we

a.Reject the null hypothesis b.Accept the null hypothesis c.Reject the research hypothesis d.Cannot determine what to do