Havermill Co. establishes a $360 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $84 for Office Supplies, $159 for merchandise inventory, and $33 for miscellaneous expenses. The fund has a balance of $84. On October 1, the accountant determines that the fund should be increased by $72. The journal entry to record the establishment of the fund on September 1 is:

A. Debit Cash $360; credit Accounts Payable $360.

B. Debit Cash $360; credit Petty Cash $360.

C. Debit Petty Cash $360; credit Cash $360.

D. Debit Petty Cash $360; credit Accounts Payable $360.

E. Debit Miscellaneous Expense $360; credit Cash $360.

Answer: C

You might also like to view...

E-mail marketing campaigns can be directed to consumers who abandon shopping carts without making a purchase to offer additional incentives to complete the purchase

Indicate whether the statement is true or false

On April 2, Reid Inc., a calendar year taxpayer, paid a $750,000 lump-sum price to purchase a business. The appraised FMVs of the balance sheet assets were:Accounts receivable?$ 38,000??Inventory?415,000??Fixtures and equipment? 147,000????$ 600,000??Which of the following statements is false?

A. Reid's amortization deduction for the current year is $7,500. B. Reid may amortize the $150,000 cost for both book and tax purposes. C. Reid must capitalize $150,000 of the cost as purchased goodwill. D. None of the above is false.

In the future, there will be greater emphasis on precision marketing as opposed to mass marketing

Indicate whether the statement is true or false

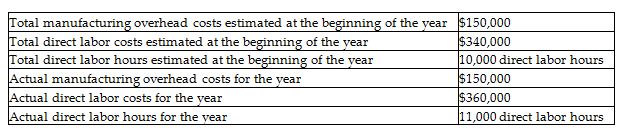

Archangel Manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on direct labor costs. The production details for the year are given below:

Calculate the manufacturing overhead allocation rate for the year based on the above data. (Round your final answer to two decimal places.)

A) 44.12%

B) 240.00%

C) 11.33%

D) 27.27%