Use the information below to answer the following question(s):Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.Increase = I Decrease = D No Effect = NAOn March 1, Year 2, King Co. collected a note receivable and related interest from Havilland Co. The note had been issued one year earlier. Indicate the effects of this event on the elements of King's financial statements.

What will be an ideal response?

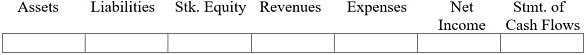

(I) (NA) (I) (I) (NA) (I) (I)

Collecting the note on March 1, Year 2, increases total assets (cash) by the amount collected (that is, the principal plus all interest), decreases total assets (note receivable) by the principal, decreases total assets (interest receivable) by the amount of interest that had been accrued at the end of Year 1, and increases stockholders' equity (retained earnings) by the amount of interest earned in Year 2. It increases revenue (interest revenue) by the amount of interest earned in Year 2, which increases Year 2 net income. The cash received on the principal is reported as a cash inflow from investing activities, and the cash received from interest is reported as a cash inflow from operating activities.

You might also like to view...

Saying, "We didn't cause this negative event to happen, it was some other company" is an example of using the impression management technique of:

A) an expression of innocence B) an excuse C) moral ambiguity D) a justification

How would you describe the current role of the IASB in setting accounting standards?

Which of the components on Blake & Mouton’s Leadership Grid has medium concern for interpersonal relationships and task accomplishment?

A. authority compliance B. country club C. impoverished D. middle of the road

Why is a full SWOT analysis not essential when using a competitive comparison framework to

compare a company's principal competitors? A) The opportunities and threats are similar for principal competitors. B) The competition between principal rivals is based on equality of strengths but not weaknesses. C) Most principal competitors are well established in a market. D) The market leaders have obvious superiority in most areas.