What is the present value of growth opportunities for ART?

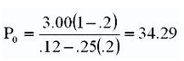

ART has come out with a new and improved product. As a result, the firm projects an ROE of 25%, and it will maintain a plowback ratio of .20. Its earnings this year will be $3 per share. Investors expect a 12% rate of return on the stock.

A. $8.57

B. $9.29

C. $14.29

D. $16.29

B. $9.29

PVGO = P 0 - (EPS 1 /k) = 34.29 - (3/.12) = $9.29

You might also like to view...

How does a loyal brand community support the positioning and branding of a small business? Provide an example to support your explanation

What will be an ideal response?

Harrti Corporation has budgeted for the following sales: July$446,800?August$581,800?September$615,900?October$890,900?November$739,000?December$699,000?Sales are collected as follows: 10% in the month of sale; 60% in the month following the sale; and the remaining 30% in the second month following the sale. In Razz's budgeted balance sheet at December 31, at what amount will accounts receivable be shown?

A. $850,800 B. $699,000 C. $629,100 D. $221,700

A non-media connector can either be a professional or a consumer

Indicate whether the statement is true or false

The ________ index is a useful tool for making preference decisions

a. preferential b. taxing c. discounting d. profitability