Identify a true statement about the conservation movement.

A. It argued that the natural world was valued as a resource, providing humans with both direct benefits and indirect benefits.

B. It believed that the natural world does not have the productive capacity to produce long-term income.

C. It argued that the natural world is available only for the exploitation of human beings.

D. It considered natural resources to be able to provide an inexhaustible supply of material.

Answer: A

You might also like to view...

Identify a true statement about the stakeholder theory.

A. It holds that a firm's financial goals must be balanced against, and perhaps even overridden by, environmental considerations. B. It suggests that the long-term financial well-being of every firm is directly tied to questions of how the firm both affects and is affected by the natural environment. C. It suggests that firms should fully integrate economic and social goals by bringing social responsibilities into the core of their business model. D. It argues that the narrow economic model fails both as an accurate descriptive and as a reasonable normative account of business management.

In Hudgens v. NLRB, warehouse employees of the Butler Shoe Co went on strike to protest the company's failure to agree to demands made by their union in contract negotiations. The union filed an unfair labor practice charge against Hudgens with the Board, alleging interference with rights protected by Section 7 of the NLRA. The U. S. Supreme Court held that the case should be remanded to the:?

A) ?Court of general jurisdiction. B) District Court.? C) National Labor Relation Board.? D) Trial Court.

Securities offerings on the Internet are:

a. prohibited by the SEC unless secondary to a regular offering b. permitted by the Capital Markets Efficiency Act but are not common c. permitted by the Capital Markets Efficiency Act, which preempts normal regulatory rules d. not subject to any controls because they evade the rules of the securities acts e. none of the other choices

The firm's cost of retained earnings is ________.

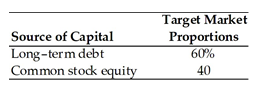

A firm has determined its optimal structure which is composed of the following sources and target market value proportions

Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $5. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.10. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm has a marginal tax rate of 40 percent.

A) 10.2 percent

B) 14.3 percent

C) 18.9 percent

D) 15.0 percent