The supply of loanable funds would shift to the right if either

a. tax reforms encouraged greater saving or the budget deficit became smaller.

b. tax reforms encouraged greater saving or investment tax credits were increased.

c. the budget deficit became larger or investment tax credits were increased.

d. the budget deficit became larger or tax reforms discouraged saving.

a

You might also like to view...

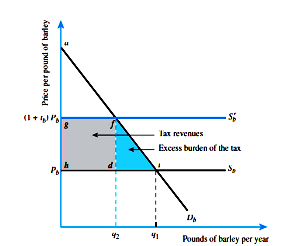

Refer to the figure below. Suppose that the demand curve for barley can be characterized by the equation P = 100 - 2Q d . Suppose further that price was $10.00 and a $10.00 tax is imposed on the market.

(A) How many barleys would be purchased at a price of $10.00? After tax?

(B) What is the amount of tax revenue generated by the tax?

(C) How much excess burden is generated by the tax?

(D) What is the amount of consumer surplus before and after the tax? What is the difference in

consumer surplus? Is it equal to excess burden plus the tax revenue?

Define rent seeking. Is rent-seeking activity likely to be highly profitable in the long run? Why or why not?

What will be an ideal response?

According to the net exports effect, as the price level falls relative to the rest of the world,

a. foreigners buy fewer goods. b. foreigners buy more U.S. goods. c. the aggregate demand curve shifts to the left. d. the aggregate demand curve shifts to the right. e. the supply of U.S.-made goods increases.

Discuss the opposing points of view on U.S. trade deficit