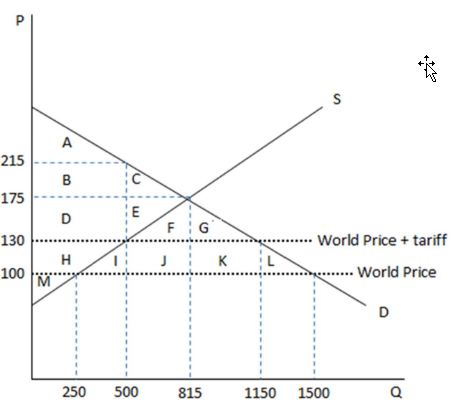

According to the graph shown, if the economy is operating under free trade, who would be in favor of a tariff?

This graph demonstrates the domestic demand and supply for a good, as well as a tariff and the world price for that good.

A. Domestic producers

B. Domestic consumers

C. Foreign producers

D. Foreign governments.

A. Domestic producers

You might also like to view...

In 2007, France's GDP totaled $1.9 trillion and in 2006 GDP was $1.8 trillion. The total amount spent on new capital in 2007 was $357 billion and in 2006 was $335 billion

To calculate the amount of net investment in France for these years, you need to know ________. A) saving B) depreciation C) the amount of financial capital available. D) the aggregate production function.

Assume a consumption function of the following form: C = 500 + .9Y. If income rises by $100, consumption will increase by

A) $90. B) $550. C) $590. D) $600.

The most important difference between unit excise taxes and ad valorem excise taxes is _____

a. the unit tax will change in response to a change in the price of the taxed good, while the ad valorem tax will not b. the unit tax will not change in response to a change in the price of the taxed good, while the ad valorem tax will c. the unit tax increases in response to a change in the price of the taxed good, while the ad valorem tax will decline d. the unit tax declines in response to a change in the price of the taxed good, while the ad valorem tax will increase

What effect would taxation have on real consumption spending when government spending is autonomous?

A) Taxation reduces real consumption spending. B) Taxation increases real consumption spending. C) Taxation causes both real consumption spending and planned real saving to increase. D) None of the above is correct.