When firms are interdependent,

A. Then the market is perfectly competitive.

B. They can act independently of one another.

C. One firm can ignore other companies in the market when making decisions.

D. The profit of one firm depends on how its rivals respond to its strategic decisions.

Answer: D

You might also like to view...

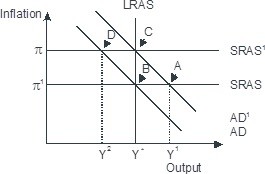

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

In reality, according to the model developed in Section 15.5 of the textbook, prices of non-renewable resources have not increased continually because of

A) abundance of the resource. B) technological progress changing marginal cost. C) changing market power of producers. D) All of the above.

A tax on wages will

a. reduce labor supply since leisure becomes cheaper. b. raise labor supply since income is reduced. c. have an unpredictable impact on labor supply since there are both substitution and income effects. d. have a predictable impact since economists know substitution effects will dominate.

An increase in short-run aggregate supply is

A) the result of an increase in the price level. B) represented by a movement up along the SRAS curve. C) represented by a rightward shift in the SRAS curve. D) both a and b E) both a and C