What should be the impact on the U.S. interest rates if the Fed undertakes a sterilized foreign exchange intervention? Be sure to explain your answer.

What will be an ideal response?

A sterilized foreign exchange intervention is designed to alter the asset side of the Fed's balance sheet but to leave the monetary base unchanged. For example, the Fed could purchase euros (sell dollars) which itself would raise reserves. But as the Fed does this it could also sell U.S. Treasury securities to reduce reserves, thereby not altering the reserves (monetary base). If the monetary base is not altered the domestic interest rates should remain the same.

You might also like to view...

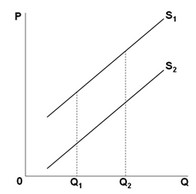

Use the diagram of two product supply curves to answer the following question. The diagram indicates that

The diagram indicates that

A. over range Q1Q2 price elasticity of supply is the same for the two curves. B. over range Q1Q2 price elasticity of supply is greater for S2 than for S1. C. over range Q1Q2 price elasticity of supply is greater for S1 than for S2. D. not enough information is given to compare price elasticities.

Suppose a computer manufacturer purchases a $100 case from a supplier, a $300 computer chip from another supplier, and sells the computers for $1000 . How much did the company contribute to GDP?

a. $1000 b. $900 c. $700 d. $600 e. $400

The explicit costs of an item include all of those things that must be forgone to acquire that item

a. true b. false

The possession of monopoly power and the willful acquisition of that power is

A. defined by the Supreme Court as monopolization. B. not defined as monopolization until a statement about profits is included. C. not the definition of monopolization. D. defined in the Sherman Antitrust Act as monopolization.