Assume that a one-year Malaysian bond yields 10 percent interest and that the dollar return on maturity is 5 percent. If the exchange rate at maturity is $1 = MYR 4.00 (Malaysian ringgit), what was the exchange rate at the time the bond was purchased?

a. $1 = MYR 4.2

b. $1 = MYR 3.8

c. $1 = MYR 3.6

d. MYR 1 = $0.26

e. MYR 1 = $0.4

b

Economics

You might also like to view...

What is signaling?

What will be an ideal response?

Economics

Moral hazard is not eliminated in debt financing because

A) borrowers have an incentive to assume greater risk than is in the interest of the lender. B) firms with a great deal of debt often go bankrupt. C) principal-agent problems are greater with debt financing than with equity financing. D) the use of restrictive covenants tends to increase moral hazard.

Economics

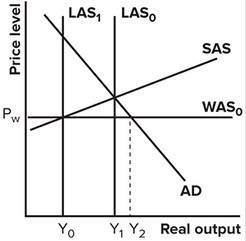

In the graph shown, what is the globally-constrained potential output?

A. Y1 B. Y2 - Y1 C. Y2 - Y0 D. Y0

Economics

What is human capital? How is it related to labor markets?

What will be an ideal response?

Economics