Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

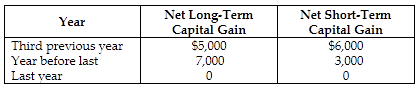

Lass Corporation reports a $25,000 net capital loss this year. The corporation reports the following net capital gains during the past three years.

The capital loss offsets all $11,000 of capital gain reported in the third previous year, and $14,000 can be carried over to the year before last. $10,000 of the carryover is used in the year before last, leaving $4,000 to be carried over to next year.

You might also like to view...

The development of a new television show using the same format as an existing series is an example of a dynamically continuous innovation

Indicate whether the statement is true or false

Ron and Gail plan to lower Fun-Spot's prices in an effort to encourage customers to stay longer, visit more often, and spend more money during each visit. What type of strategy are Ron and Gail planning?

A) market penetration B) market development C) product development D) product adaptation E) diversification

What are four employee rights under the Equal Employment Opportunity Commission?

What will be an ideal response?

In a debate, ______ involves pointing out the flaws of the other side’s arguments and rebuilding the arguments you presented yourself.

Fill in the blank(s) with the appropriate word(s).