What is the difference between directly holding stock in a company like Apple and investing in a mutual fund that holds Apple stock?

What will be an ideal response?

• Some investors purchase Apple shares directly and hold them in a brokerage account.

• Most investors buy pre-mixed pools of assets, called mutual funds.A mutual fund is a pool of money that is collected from many investors. Mutual funds typically invest in hundreds of stocks, bonds, and/or short-term money market instruments.

A-head: INVESTMENT ACCOUNTS

Concept: Brokerage accounts

You might also like to view...

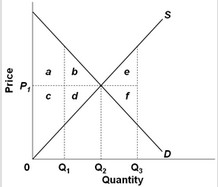

Use the figure below to answer the following question. The equilibrium point in the market is the point at which the S and D curves intersect. Assuming equilibrium price P1, consumer surplus is represented by areas

Assuming equilibrium price P1, consumer surplus is represented by areas

A. a + c. B. a + b + c + d. C. c + d. D. a + b.

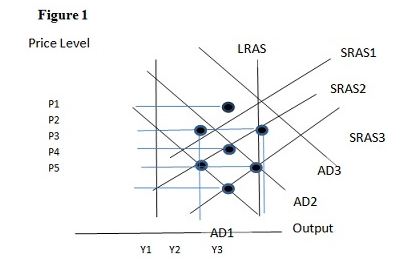

Using Figure 1 below, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2.

B. P3 and Y1.

C. P2 and Y3.

D. P2 and Y2.

Deepening of human capital in the U.S. economy focuses: a. more on additional education and training than on a higher average level of work experience. b. more on a higher average level of work experience than on additional education and training. c. more on the reduction of the cost of capital than on additional training

d. more on increasing the stock of physical capital than on higher education.

If the price elasticity of demand for U.S. automobiles is higher in Europe than it is in China, and transport costs are zero, a price-discriminating monopolist would charge

A) the same price for autos in China as in Europe. B) a lower price for autos in China than in Europe. C) a higher price for autos in China than in Europe. D) a less profitable price for autos in China than in Europe.