Progressive Insurance examined insurance from the customers' viewpoint and saw how difficult it was to get an auto claim processed and paid by insurance companies. Then the company crafted its service strategy around solving that problem. The company now has fleets of claim adjustors on the road every day, ready to rush to the scene of an accident in their territory and provide fast claims processing-sometimes on the spot. Progressive Insurance relies on ________ service standards.

A. Customer-defined

B. Service provider-defined

C. Company-defined

D. Cost-focused

E. Competitor-focused

Answer: A

You might also like to view...

Under Armour's decision to add athletic shoes to its apparel line in 2006 is an example of a ________ strategy

A) market penetration B) market development C) downsizing D) diversification E) product development

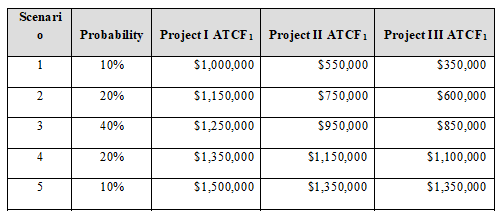

Powerful Wind, Inc. is a wind turbine manufacturer that is considering three investment projects: I, II, and III, that will cost $2,500,000, $2,300,000, and $3,700,000, respectively. The projects have an expected life of three, five, and seven years, correspondingly. The firm’s Vice President of Finance has estimated the probability distribution for each project’s first after-tax cash flow (ATCF1) as shown in the following table:

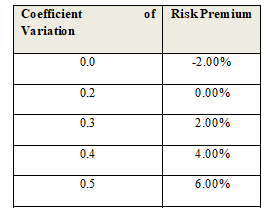

The Vice President of Finance uses the risk-adjusted discount technique to evaluate investment projects. He allocates risk premiums based on the coefficient of variation of each project’s after-tax cash flows according to the following table:

1. Each project’s after-tax cash flows are expected to grow at an annual rate of inflation of 3%.

a) Determine the expected cash flow, standard deviation, and coefficient of variation of each project in Year 1.

b) If the firm’s WACC is 15%, what is the appropriate risk-adjusted required rate of return of each project?

c) Using the appropriate discount rates, determine the payback period, discounted payback period, NPV, PI, IRR, and MIRR for each project.

d) If the projects are mutually exclusive, which project should be accepted? Answer the same question assuming they are independent projects.

6. Use the data of the previous problem to perform the following analysis:

a) Perform a sensitivity analysis using a Data Table. Determine the NPV, IRR, and PI as the ATCF1 takes on each possible outcome.

b) Determine the expected value and standard deviation of the NPVs, PI, and IRR of all projects.

c) Determine the coefficient of variation of the NPV, PI, and IRR of all projects.

d) Calculate the probability of a negative NPV, a PI less than one, and an IRR less than the required return for all projects.

e) Based on your results for parts (a), (b), (c), and (d), which project should be accepted?

Which is true about the consolidation of support services?

A. While the service desk model is popular, most companies prefer to use the help desk model and focus on delivering only computer-related services. B. The sheer complexity of technology, the related security issues, and the need for extensive training are curtailing the consolidation of support services. C. Having the service desk maintain user accounts and perform some security-related activities has reduced the time required to satisfy these requests, and enhanced customer satisfaction. D. Most organizations find it difficult to rotate other analysts, such as application developers or customer representatives, into the service desk, resulting in a lack of shared knowledge and communication.

The Securities and Exchange Commission (SEC) wants to review certain documents of Trade Funds Inc. Whether it is permissible for the SEC to request or review the documents depends on whether the documents are

A. incriminating. B. relevant. C. technical. D. valuable.