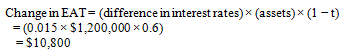

Hicks Health Clubs, Inc., expects to generate an annual EBIT of $750,000 and needs to obtain financing for $1,200,000 of assets. Its tax bracket is 40%. If the firm uses short-term debt, its rate will be 7.5%, and if it uses long-term debt, its rate will be 9%. By how much will their earnings after taxes change if they choose the more aggressive financing plan instead of the more conservative plan?

A) $10,800

B) ($10,000)

C) ($6,000)

D) $6,000

A) $10,800

You might also like to view...

Pressuring the union and employees to accept wage and work rule concessions is known as a ________ strategy.

Fill in the blank(s) with the appropriate word(s).

Mays Company sold a machine for $10,000 cash. The machine originally cost $65,000 and the company had recognized $53,000 in depreciation over the life of the machine. What is the effect of this sale on Mays Company's income statement and its statement of cash flows?

A conventional desk-top cooling fan costs as little as £20. The Dyson Air Multiplier has a recommended retail price of £200. Despite this huge price differential, the Dyson product is highly successful. What are the strategic implications of this story?

What will be an ideal response?

The graph of the relationship between expected return and beta in the CAPM context is called the _________.

A. CML B. CAL C. SML D. SCL