Describe the accounting for employee stock options (ESOs)

Employee Stock Option Plans

An understanding of the accounting for employee stock options (ESOs) requires several definitions. The grant date is the date a firm awards a stock option to employees. The vesting date is the first date employees can exercise their stock options. The vesting period is the period between the grant date and the vesting date. A vesting period that depends only on the passage of time is a service condition; a vesting period that depends on achieving a specified level of profitability or meeting some other nonshare-price-based target is a performance condition; and a vesting period that depends on the firm's stock price reaching a specified target is a market condition. The purpose of these conditions is to increase the likelihood that the employee continues to work for the firm and to motivate the employee to take actions that will increase the stock price.

The exercise date is the date employees exchange the option and cash for shares of common stock. The exercise price is the price specified in the stock option contract for purchasing the common stock. The market price is the price of the stock as it trades in the market.

The value of a stock option results from two elements:

1 . The benefit realized on the exercise date, because the market price of the stock exceeds the exercise price (the benefit element) equal to the intrinsic value of the option on the exercise date.

2 . The length of the period during which the holder can exercise the option (the time value element).

One cannot measure the amount of the benefit element before the exercise date. Stock options with exercise prices less than the current market price of the stock (described as in the money) have a higher value, other things equal, than stock options with exercise prices exceeding the current market price of the stock (described as out of the money). The time value element results from the possibility of increases in the market price of the stock during the exercise period. Time value is larger the longer the exercise period and the more volatile the market price of the stock. A stock option whose exercise price exceeds the current market price (zero intrinsic value and therefore zero value for the benefit element) has economic value because of the possibility that the market price will exceed the exercise price on the exercise date (positive value for the second element). As the expiration date of the option approaches, the value of the second element approaches zero.

The accounting for employee stock options involves the following:

1 . Measure the fair value of stock options on the date of the grant using an option-pricing model that incorporates information about the current market price, the exercise price, the expected time between grant and exercise, the expected market price volatility of the stock, the expected dividends, and the risk-free interest rate. Total compensation cost is the number of options the firm expects to vest times the fair value per option. Firms use their historical experience on forfeitures due to employees terminating employment prior to vesting to estimate the expected number of options that will vest.

2 . Amortize the fair value of the stock options on the date of the grant over the requisite service period, which is the expected period of benefit. The requisite service period, usually the period from the date of the grant to the date of vesting, is the period over which an employee must provide services in order to vest in the options. The firm debits Compensation Expense and credits Additional Paid-In Capital (Stock Options) for the amount amortized. The firm does not recompute the fair value of the option at each succeeding balance sheet date to reflect new information about stock prices, volatility, dividend yield, or risk-free interest rates.

3 . When employees exercise their options, the firm debits Cash for the proceeds, debits Additional Paid-In Capital (Stock Options) for any amounts credited to that account in step 2 above, credits Common Stock for the par value of the shares issued, and credits Additional Paid-In Capital for any excess of the cash received plus the amount amortized in step 2 above over the par value of the shares issued.

The accounting for stock options is complex because firms often include combinations of service, performance, and market conditions and because firms can restructure their plans.

You might also like to view...

Defusing a situation with a customer by acknowledgment can be used in every unhappy situation with any customer.

Answer the following statement true (T) or false (F)

A yea-saying pattern may be evident on one respondent in the form of all "yes" or "strongly agree" answers

Indicate whether the statement is true or false

At the beginning of the year, Barrington Manufacturing had the following account balances:

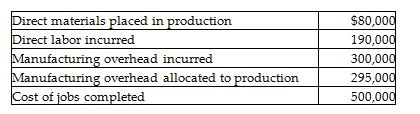

The following additional details are provided for the year:

Record these transactions in the T-accounts and calculate the ending balances for Work-in-Process Inventory, Finished Goods Inventory, and Manufacturing Overhead accounts (unadjusted).

Accounts payable $ 30,000 Accounts receivable 65,000 Accrued liabilities 7,000 Cash 20,000 Intangible assets 40,000 Inventory 72,000 Long-term investments 100,000 Long-term liabilities 75,000 Marketable securities 36,000 Notes payable (short-term) 20,000 Property, plant, and equipment 625,000 Prepaid expenses 2,000 Based on the above data, what is the amount of quick assets?

A) $163,000 B) $195,000 C) $121,000 D) $56,000