You value your favorite shirt at $100. Someone else values it at $80, and that person is willing to pay you $80 for your shirt. Would selling your shirt to this person for $80 be Pareto efficient?

A. Yes, because even though you lose from the trade and he gains, there is the potential for him to compensate you for your loss.

B. Yes, because any time you engage in trade, the result must be Pareto efficient.

C. No, the person paid you $80 for the shirt so his net benefit was $0, while your net benefit was -$20. For this change to be Pareto efficient, each of you should have the same net benefit.

D. No, because both of you are not better off as a result of the trade.

Answer: D

You might also like to view...

There is a difference between who is legally required to send a tax payment to the government and who bears the burden of the tax. Which of the following would have the most impact on who bears the burden of an excise tax?

A) The elasticity of demand for the item that is taxed. B) whether the tax is based on the ability-to-pay principle or the benefits-received principle C) whether the tax is imposed by the federal government or a state government D) The motive for the tax. If the tax is designed to raise revenue, more of the burden will fall on firms. If the tax is designed to achieve a social objective (for example, to discourage smoking) more of the burden will fall on consumers.

Table 11-2 QTRTC89590910293 10110100 11112105 12115110 ? In Table 11-2, MC of the last unit produced at the profit-maximizing output is

A. $5. B. $7. C. $8. D. $10.

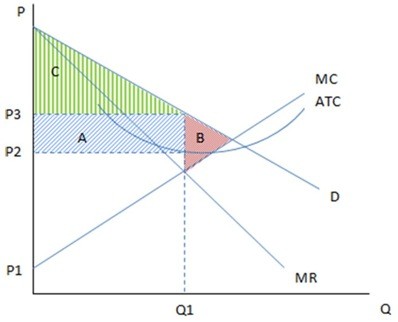

These are the cost and revenue curves associated with a monopolistically competitive firm. According to the graph shown, the monopolistically competitive firm will produce:

According to the graph shown, the monopolistically competitive firm will produce:

A. where MR = MC and will charge according to D. B. where D = MC and will charge according to MR. C. where D = MC and will charge according to ATC. D. where MR = MC and will charge according to ATC.

Government regulations that deal with financial crises tend to become less effective over time.

Answer the following statement true (T) or false (F)