Social Security payroll taxes are examples of

A. progressive taxation.

B. regressive taxation.

C. proportional taxation.

D. marginal taxes.

Answer: B

You might also like to view...

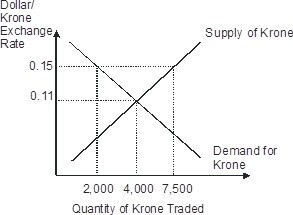

Based on this figure, if the krone exchange rate is fixed at $0.15 dollars per krone, then the krone is:

A. overvalued B. undervalued C. devalued D. revalued

Describe what the liquidity trap is. Explain how it can be problematic for monetary policymakers

What will be an ideal response?

Consider an individual who plans to buy a new home. He has two options: (i) pay for mortgage insurance (that insures the lender in case the borrower defaults), or (ii) pay the lender a higher interest rate for the mortgage. Describe how these two options are related to the concept of risk premium and the lender's aversion to risk. Why does the interest rate on the mortgage differ in these two options?

What will be an ideal response?

The monetarist and the Keynesian approaches are two competing theories of aggregate demand.

Answer the following statement true (T) or false (F)