The price that the writer of a call option receives for the underlying asset if the buyer executes her option is called the

A. strike price.

B. exercise price.

C. execution price.

D. strike price or exercise price.

E. strike price or execution price.

D. strike price or exercise price.

The price that the writer of a call option receives for the underlying asset if the buyer executes her option is called the strike price or exercise price.

You might also like to view...

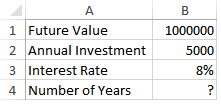

You are planning for an early retirement, so you decide to invest $5,000 per year, starting at age 23. You plan to retire when you accumulate $1,000,000. If the average rate of return on your investments is 8%, which formula in B4 will allow you to determine how many years you must invest?

a) =NPER(B3,-B2,0,B1)/23

b) =NPER(B3,-B2,0,B1)*23

c) =NPER(B3,-B2,0,B1)

d) =NPER(B1,-B3,0,B2)

What is generally TRUE about class B SKUs in ABC analysis? They represent about:

A) 20 percent of all SKUs and about 80 percent of the dollar usage. B) 80 percent of all SKUs and about 20 percent of the dollar usage. C) 30 percent of all SKUs and about 15 percent of the dollar usage. D) 50 percent of all SKUs and about 95 percent of the dollar usage.

Using DNA data to deny an employee health insurance is a type of discrimination prohibited by federal law

Indicate whether the statement is true or false

When a person sells a common stock short, she or he is betting that the price of the stock will fall

Indicate whether the statement is true or false.