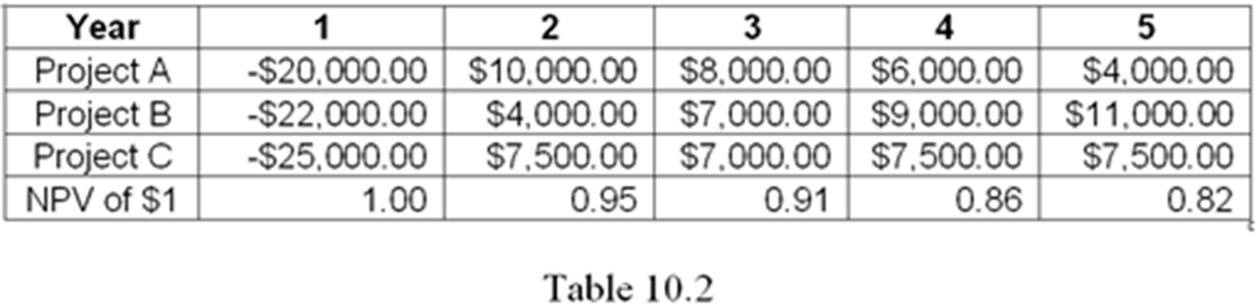

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose. Each project requires an investment in the first year, then produces a positive net cash flow for each of the following four years. Assuming an interest rate of 5%, which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

What will be an ideal response?

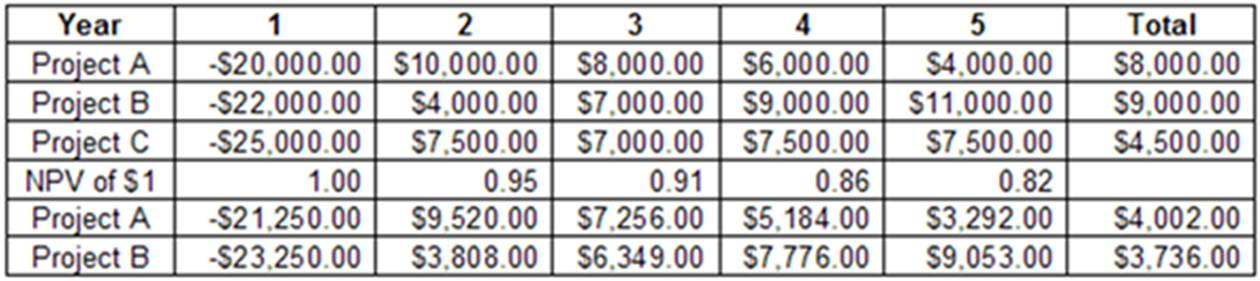

The NPV of each project is calculated in the following table:

Project C has the highest NPV. However, it doesn't have the highest total net cash flow. Project C also does not have the shortest payback period. Net cash flow from Project A becomes positive in year 4. Net cash flow from Project C doesn't become positive until year 5.

You might also like to view...

What is the "underwriting spread?"

A) the average percentage of the total bond issue handled by a member of an underwriting syndicate B) the difference between the price the underwriters receive and the price they pay the borrower C) the length of time the underwriter agrees to withhold the bonds from the primary market D) the number of financial institutions in the underwriting syndicate

A monopolist is a price taker, just like a perfect competitor.

Answer the following statement true (T) or false (F)

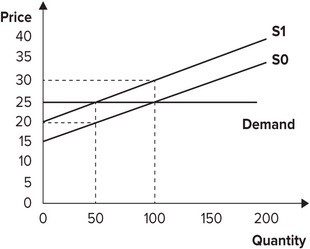

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $25 and quantity equal to 100. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. reduce producer surplus by $400. B. give government tax revenues of $400. C. reduce producer surplus by $375. D. give government tax revenues of $100.

Which of the following affects a person's decision to work?

A. the price of consumption goods relative to the wage B. how much the person enjoys working C. the person's income from nonlabor sources D. the amount of fringe benefits offered to the person E. All of the above affect a person's decision to work.