Higher stock prices can lead to greater investment spending by firms because:

A. the firm gets 100 percent of the increase in the stock value.

B. the market value of a firm is now less than the replacement cost of the firm.

C. the cost of internal financing is lower and the firm also gets 100 percent of the increase in the stock value.

D. the cost of external financing is lower.

Answer: D

You might also like to view...

Most economists think changes in which type of unemployment affects inflation?

A) frictional unemployment B) cyclical unemployment C) structural unemployment D) natural rate of unemployment

When a monopolistically competitive firm is in long-run equilibrium,

a. marginal revenue is equal to marginal cost. b. average total cost is minimized. c. marginal revenue is tangent to average total cost. d. All of the above are correct.

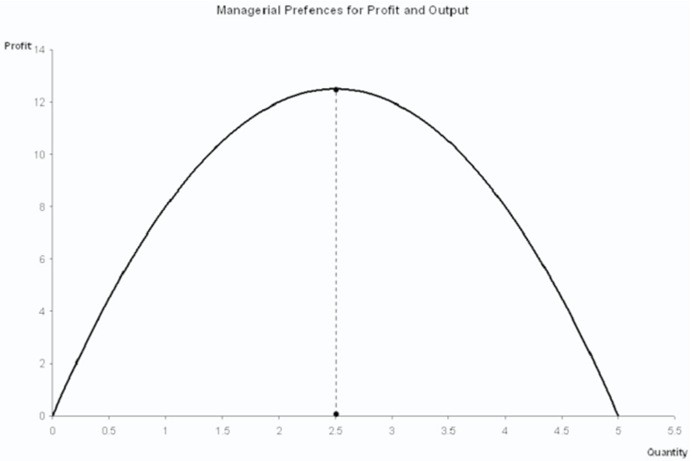

Suppose a manager views both quantity and profit as "goods." Such a manager will then have an indifference curve that:

A. is tangent to the profit curve somewhere between quantities of 0 and 2.5. B. intersects the profit curve at a quantity exactly equal to 2.5. C. is tangent to the profit curve somewhere between quantities of 2.5 and 5. D. intersects the profit curve at a quantity exactly equal to 5.

Gross domestic product is

A. NDP less changes in inventories. B. NDP plus net exports. C. NDP plus taxes. D. NDP plus depreciation.