During the expansion phase of the business cycle, households become optimistic about their future earning capacity as do banks. Nominal interest rates rise during expansions. Mortgage lending could be expected to

A) rise if the change in future earnings is thought to be greater than the change in interest rates.

B) stay the same.

C) fall.

D) fall if the change in future earnings is thought to be greater than the change in interest rates.

B

You might also like to view...

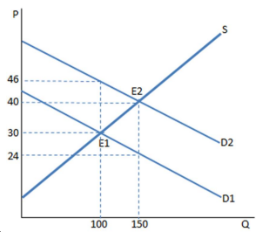

A subsidy to buyers has been placed in the market in the graph shown. Why might the government enact such a policy?

A. As a way to encourage the consumption of the good

B. As a way to encourage consumers to substitute away from the good

C. As a way to discourage the production of the good

D. As a way to discourage the consumption of the good

The full employment level of GDP is sometimes referred to as “potential GDP.”

Answer the following statement true (T) or false (F)

The CPI is a measure of the overall cost of the goods and services bought by a typical consumer

a. True b. False Indicate whether the statement is true or false

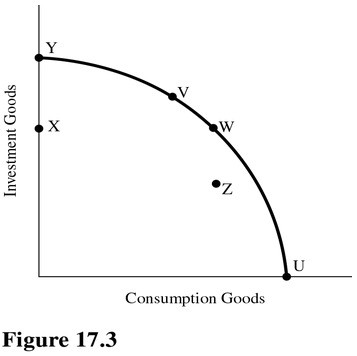

Refer to Figure 17.3. Assume X units of plants and equipment wear out each year. What will happen to the PPC in the future if the economy currently produces at a point near V?

Refer to Figure 17.3. Assume X units of plants and equipment wear out each year. What will happen to the PPC in the future if the economy currently produces at a point near V?

A. It will stay the same. B. It will shift inward. C. It will shift outward. D. This cannot be determined with the information given.