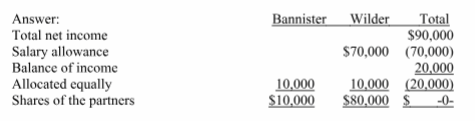

Bannister invested $110,000 and Wilder invested $99,000 in a new partnership. Their partnership agreement called for Wilder to receive a $70,000 annual salary allowance. Under this agreement, what are the income or loss shares of the partners if the annual partnership income is $90,000?

What will be an ideal response?

You might also like to view...

The net present value and internal rate of return methods of decision making in capital budgeting are superior to the payback method in that they

a. consider the time value of money. b. are eaiser to implement. c. reflect the effects of sensitivity analysis. d. require less input.

Kim has investments in stocks, and wants to calculate her total return. What should she do?

a. Divide the yearly dollar amount of dividend income by the investment's current market value.

b. Compare the dividend against current yields from other investments.

c. Subtract the cost of the stock from what she sold it for.

d. Divide the current dividend payment plus capital gain by the original investment.

e. Subtract current liabilities from current assets.

The litigation process has three phases: filing, answering, and appealing

Indicate whether the statement is true or false

Diva Boutique, located in Manhattan, relies on external advertising agencies for its advertising needs, but due to its growing global presence, it is now worried that using external agencies may lead to inconsistency in delivery of its brand image. It also wants to maintain tighter control over its advertising and promotional activities. Which of the following advertising agencies should it adopt?

A. collateral service agency B. Centralized agency C. creative boutique D. buzz marketing agency E. in-house agency